International Processing

bridge_admin,

May 01 , 2018

International Processing

May 01 , 2018International Processing

BridgePay is able to offer our partners and merchants several options for international processing. While our list of currencies is expanding, we made sure our partners would be able to offer their merchants a multitude of international processing options via the BridgePay Gateway. Currently, the BridgePay Gateway can process in the following currencies: British Pound Canadian Dollar Euro-covering 27 European countries Australian Dollar More global currencies being added Through our various international partnerships, BridgePay offers PCI-compliant payment solutions for e-commerce, mail-order and telephone order merchants. The BridgePay Gateway accepts all major payment types for both the US and Canada and has e-commerce fraud protection suite in place to make sure you are transacting in the safest possible environment.Popular Post

Gift Link

bridge_admin,

May 01 , 2018

Gift Link

May 01 , 2018Developed specifically for small to mid-sized merchants, GiftLINK eliminates the complexity of traditional gift card programs by delivering a feature-rich, cost-effective solution designed for quick implementation and revenue generation. Low flat-fee transaction processing Custom cards and carriers available Based on a PCI-compliant platform, GiftLINK is a closed-loop program that offers the best security and reliability in the industry. A dedicated website provides merchants with a full range of easy-to-use options, including reporting, visibility to multiple retail locations, user set up programs, and balance inquiries. Best of all, GiftLINK's design minimizes training time and emphasizes quick implementation and immediate sale. Call 866-531-1460 today to order cards and find out how GiftLINK can boost your bottom line!

Popular Post

Card Account Updater 2

bridge_admin,

April 24 , 2018

Card Account Updater 2

April 24 , 2018What is CAU?

CAU is a service allowing customers to receive updated credit card information stored by BridgePay without reaching out to the customer.

CAU is a service allowing customers to receive updated credit card information stored by BridgePay without reaching out to the customer.

Robust

Flexible

Increased Transaction Approval

Decreased Decline Rate For Recurring Billing

Who wants to use CAU?

Anyone who stores credit card information in the gateway for future use.

Popular Post

WebLink

bridge_admin,

April 24 , 2018

WebLink

April 24 , 2018

![]()

![]()

![]()

![]()

![]()

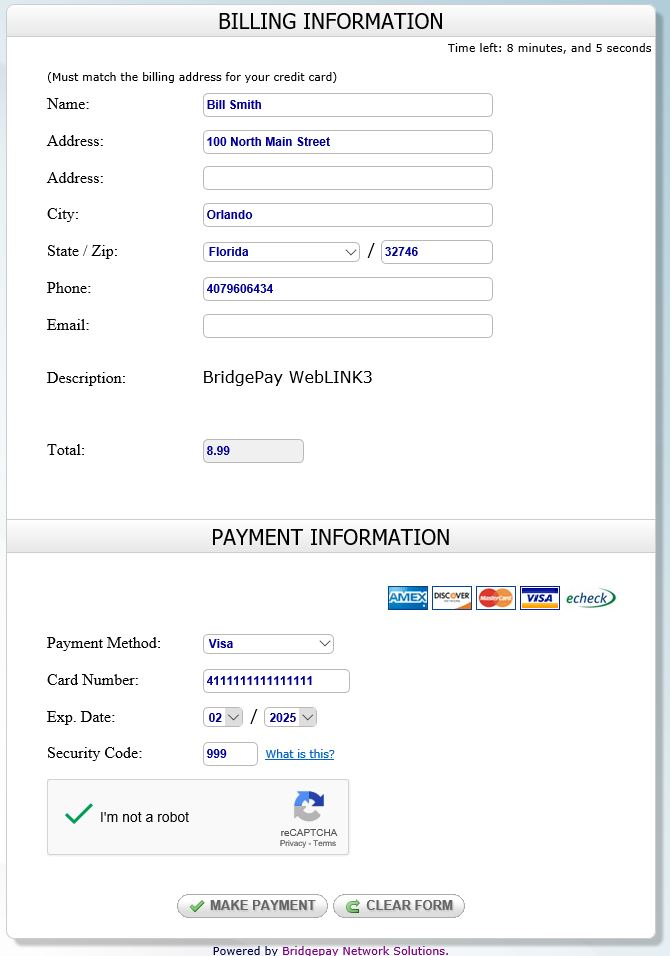

Securing your online payments is easy using BridgePay's hosted payment page, WebLINK.

- Advanced security options using iframes

- Card Vaulting or "wallet" capabilities

- Reduced fraudulent transactions using reCAPCHTA

- Templates for quick and easy simple payment page creation

- Email receipt options to both the customer and the merchant

- Custom Reporting capabilities via the BridgePay Gateway

- Custom data fields such as Invoice #, PO #, Account # and Account Types (e.g. Utility, Tax, Permits)

Popular Post

Special Industries Served

bridge_admin,

April 24 , 2018

Special Industries Served

April 24 , 2018Sometimes you have to become experts in a lot of things when you have such an amazing group of partners. But what's good for us can also be good for you!

![]()

![]() PayGuardian is also customized to meet the needs of our pharmacy partners. A list of these customized features can be viewed here.

PayGuardian is also customized to meet the needs of our pharmacy partners. A list of these customized features can be viewed here.